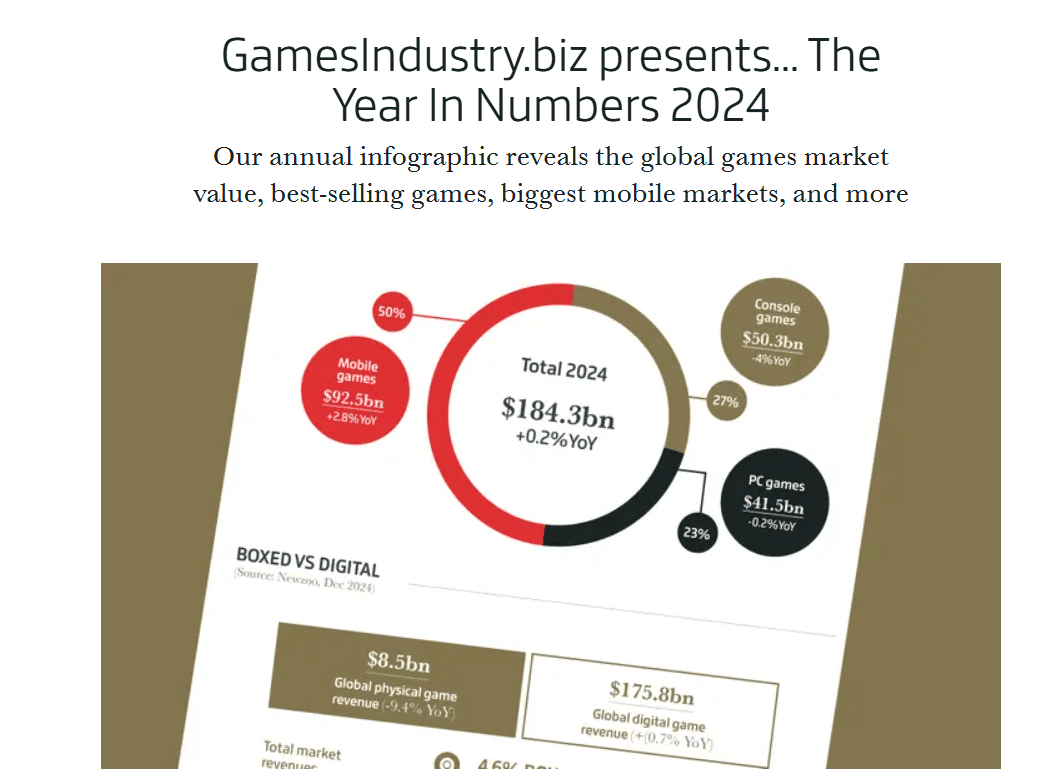

The GamesIndustry.biz report titled “The Year in Numbers 2024” provides a detailed overview of the gaming industry’s performance, highlighting key statistics and trends. Here’s a summary of the report’s main figures and insights:

- Total Revenue: Digital game sales reached $175.8 billion, while physical media sales accounted for just $8.5 billion.

- Market Growth: The global gaming market is projected to grow to $187.7 billion in 2024, reflecting a 2.1% year-over-year increase.

- Segment Breakdown:

- Mobile Gaming: Dominates the market with approximately $92.6 billion in annual revenues.

- Console Gaming: Ranked second with revenues of about $51.9 billion.

- PC Gaming: Continues to lag behind, contributing significantly less to overall revenues.

- Regional Insights: North America is expected to generate around $50.2 billion, while China is projected at $45 billion in gaming revenue.

- Future Projections: The global gaming market is forecasted to reach $221 billion by 2024 and could grow to $266 billion by 2028, with a compound annual growth rate (CAGR) of about 5%.

- Budget Trends: Budgets for AAA games are increasing, with a projected CAGR of 8% from 2022 to 2028, outpacing revenue growth.

These figures illustrate the significant shifts in consumer preferences towards digital formats and the ongoing evolution of the gaming industry as it adapts to new trends and technologies.

While the report boasts impressive figures—digital sales hitting $175.8 billion compared to $8.5 billion for physical media—it also reveals gaps and ambiguities that demand closer scrutiny. Below, we dissect these shortcomings and their implications for the current gaming landscape.

Revenue Breakdown: What Are We Really Counting?

A standout figure in the report is the $175.8 billion in digital sales, but it leaves one critical question unanswered: what exactly does this number encompass? Does it reflect only full-game purchases, or does it also include microtransactions, downloadable content (DLC), and subscription services?

Microtransactions and DLC, particularly in free-to-play games, are now major revenue drivers. Without a clear breakdown, it’s difficult to discern whether this surge in digital revenue stems from a rise in traditional game purchases or is primarily driven by these ancillary income streams.

Market Segmentation: The Devil Is in the Details

The report touches on the mobile, console, and PC gaming markets but stops short of providing specific revenue figures or growth rates for each segment. This omission is significant. Understanding which areas are thriving and which are struggling is crucial for developers and publishers shaping their strategies.

For example, if mobile gaming is fueling the growth in digital sales while console markets plateau, companies might reconsider how they allocate resources. A more granular segmentation would illuminate where the real opportunities lie.

Geographical Insights: Where Are the Players?

While the report offers a global perspective, it glosses over regional performance. How do markets in North America, Europe, and Asia compare when it comes to digital versus physical sales?

Regional dynamics matter. Consumer behavior can differ drastically across markets due to cultural and economic factors. Some regions may still prefer physical media, while others lean entirely toward digital formats. A deeper look at regional trends could offer a more nuanced understanding of global shifts, empowering stakeholders to tailor their strategies more effectively.

Trends and Predictions: What Lies Ahead?

The report hints at trends for 2025, such as a growing reliance on digital and subscription models, but stops short of making concrete predictions. How quickly will these shifts occur? And what metrics can we use to gauge their impact?

More precise projections would help industry stakeholders anticipate changes and adapt accordingly. For instance, if subscription services are poised for significant growth, developers might prioritize content suited for these platforms.

Influence of External Factors: Context Matters

Another critical oversight is the lack of discussion about external factors influencing gaming sales. The report doesn’t address how economic conditions like inflation or changes in consumer spending habits might shape purchasing behavior.

Technological advancements and industry consolidation are also missing from the analysis. For instance, as artificial intelligence streamlines game development or enhances player experiences, it could boost engagement and spending. Acknowledging these factors is vital for interpreting the data in its broader context.

Final Thoughts: A Call for Clarity

In summary, while the “Year in Numbers 2024” report sheds light on the state of the gaming industry, it leaves room for improvement in terms of clarity and depth. Future reports could benefit from:

- Detailed revenue breakdowns

- Better market segmentation

- Regional performance insights

- Clearer projections

- Consideration of external influences

By addressing these gaps, we can gain a more comprehensive understanding of the forces shaping the gaming industry and better prepare for its ever-evolving future.